The template primarily separates the cash flow into three categories – Operating Activities, Investing Activities, and Financing Activities. It further breaks down each activity into subsets, such as Net Income, Depreciation, Deferred Income Taxes, and others – contributing to a comprehensive financial snapshot. On the outgoing end, the template enables the tracking of various expenses like bank fees, fuel, material costs, site supervision, subcontractors, insurance, and waste removal, among others. It also accounts for less common expenses like PAYG Income tax installments, withholding tax, superannuation, net GST owing, and capital purchases. This template can also be used for cross-verifying the cash balance with the total bank accounts to ensure no discrepancies. Outgoing cash includes various types of expenses, such as purchases, wages, rent, utilities, advertising, and more.

How to Make Multiple Selection in Drop-down Lists in Google Sheets

As a business owner, you need to understand every aspect of your business’s operation, and the effect its activities have on the health of the business.Tools that provide such information are invaluable,… As an investor, it is important to be able to evaluate the worth of current investments and future investment opportunities.The profit that can be materialized as an investor/business owner is not restricted… Cash flow management is a process that allows you to track all of the money flowing in and out of your business. Sage financial reporting software can help with your reporting and the management and growth of your business.

Free Cash Flow Template for Google Sheets & Excel

This cash flow statement was designed for the small-business owner looking for an example of how to format a statement of cash flows. If you don’t want to separate the “cash receipts from” and the “cash paid for” then you can just delete the rows containing those labels and what are temporary accounts fanda glossary reorder the cash flow item descriptions as needed. To perform a cash flow analysis, you can compare the cash flow statement over multiple months or years. You can also use the cash flow analysis to prepare an estimate or plan for future cash flows (i.e. a cash flow budget).

Discounted Cash Flow Forecast Template

Maintain a firm grasp of your company’s financial health with this comprehensive Operating Cash Flow Template. The Cash Flow Projection Template provides a detailed breakdown of both incoming and outgoing cash over a ten-year period in millions of dollars. Incoming cash can include items like sales, loans received, new equity inflow, interest income, and other income. This template was designed by Live Flow, a trusted provider of financial management tools. At the end of each week, the template provides a summary of your cash balance, including the beginning and ending cash on hand.

Cash flow statement template (download for Excel)

The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference. This is a simple worksheet that you can customize to reflect your business type and the products or services it offers. This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use.

It also compares your ending cash balance to the minimum required cash balance, alerting you if your cash balance falls below the required threshold. This makes it easy to assess your financial situation without requiring advanced accounting skills. Being cloud-based, they also offer the advantage of real-time collaboration, making it easier for teams to work together on financial planning and analysis.

- Whether you’re a business owner or an individual, managing your cash flow is essential for maintaining financial stability.

- This method deducts cash out from cash in by focusing on cash inflows and cash outflows of cash from operating activities.

- This Free Downloadable Cash Flow Template, designed by Thomas Plaizier, is a valuable tool for small business owners who want to keep track of their cash flow efficiently.

The formula is (cash flow from operations) less (capital expenditures to support current operations). This includes expansion, research and development, major purchases, or equipment upgrades. Use a bank reconciliation to check current cash available, pending outstanding payments, and deposits in transit, because the current balance of your cash account may materially change due to pending transactions. Money in your savings account is considered cash, while the funds in your money market accounts and three-month Canadian Treasury Bills are cash equivalents. Every business owner understands the importance of tracking business expenses, income, and net cash flow.

This worksheet is for people who don’t like the word budget but still want to get a grip on their finances. Basic personal finance is mostly about managing cash flow which means tracking and planning how money is entering and leaving your real and virtual pockets. This worksheet can be used for tracking your spending as well as creating a budget. The template pulls together income and expenses data into automated charts for quick and easy analysis. The template combines data from these files to generate expenses and income reports, as well as an automated cash flow dashboard. This Google Sheets template, sourced from Spreadsheet Daddy, is specially designed for hotel businesses that want to monitor and manage their financial operations more effectively.

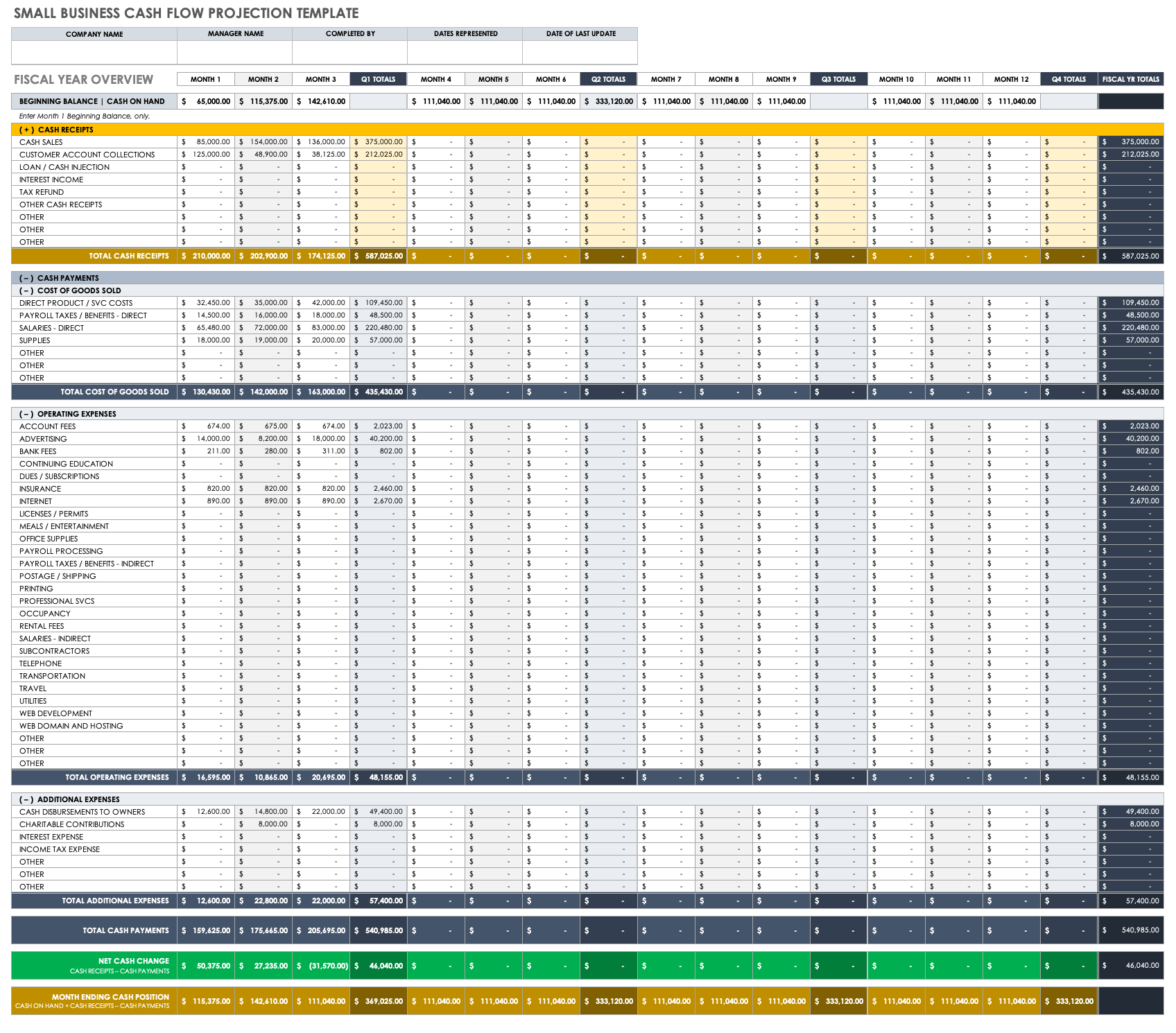

Examples of receipts under the direct method include cash collected from customers and cash received from interest and/or dividends. Examples of disbursements under the direct method include cash paid to suppliers for goods, cash paid to employees for services, and cash paid to creditors for interest and tax payments. Use this basic template to gain monthly insight into your company’s cash flow and ensure you have sufficient funds to continue operating. Fill in your information for beginning balance (cash on hand), cash receipts and disbursements (R&D), operating expenses, and additional expenses. The template will auto-tally the monthly net cash change and month ending cash position columns. Use this information to forecast how long your cash will last, and whether you need to obtain additional financing.

To download a version that you can edit and customize, download the spreadsheet below. This Google Sheets Personal Cash Flow Statement Template, adapted from an Excel template by Excel Demy, is a handy tool for managing your personal finances. As a business owner, however, you know you can’t just hope that you’re doing well financially.

A standard and basic version of this model is available, with an interactive and customizable format to suit your individual business needs. With the Weekly Cash Flow Template, you can gain a comprehensive understanding of your cash flow patterns and make informed financial decisions to ensure your financial stability and success. The “Monthly Cash Flow Template” by Vertex42 is a detailed Google Sheets template designed for comprehensive financial planning. A look back over a specific period of time (typically the last month or last quarter) enables you to look forward to the next period and to ensure you have the funds on hand to pay your bills. If you’re looking for an effective, easy-to-use template that automatically updates your finances, monitors your payments and generates financial reports, then Sheetgo is the best option for you. IFRS allows dividends and interest paid to be classified as operating or financing activities.